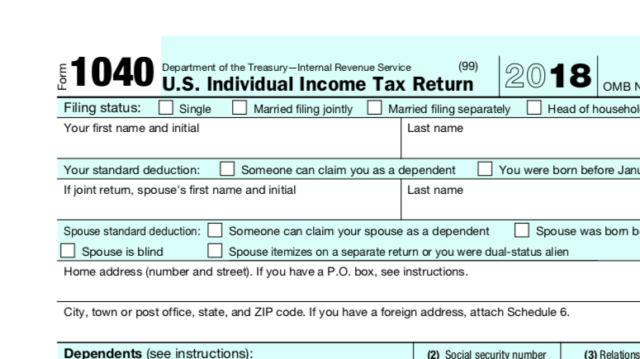

As area taxpayers begin to process their federal tax returns for 2018, some are complaining that their refunds are much lower than expected. Financial advisors with Kingdom Financial told Joel Natalie on TalkErie.com yesterday, that there were many changes for taxpayers built into the 2018 Tax Reform Act that impact individual and joint filer’s returns.

But Ben Reiter says that the size of the refund is the wrong question. “The biggest part to remember is, yes, refunds overall might be lower, but that’s not the thing we are usually concerned about. We are usually concerned about what’s your total tax; how much did you pay. And overall the numbers are still saying that people are paying less in taxes,” Reiter said.

Changes include a large increase of the standard deduction and elimination of exemptions. Reiter recommends asking questions of a tax advisor as you begin the filing process to help reduce surprises.