Last week, U.S. Rep. Mike Kelly (R-PA), Chairman of the Ways & Means Committee’s Subcommittee on Tax, along with U.S. Congressman Drew Ferguson (R-Ga.), a member of the House Ways and Means Committee, recently introduced H.R. 1010, the Prohibiting IRS Financial Surveillance Act, to ban the Internal Revenue Service (IRS) from implementing any new reporting requirements for banks or other financial institutions as part of the Biden Administration’s aggressive bank surveillance regime. Strong concerns have been raised about the privacy of individuals, the ability of the IRS to safeguard private bank account information, and the undue burdens placed on families and small businesses.

The Senate companion bill was introduced by U.S. Senator Tim Scott (R-S.C.).

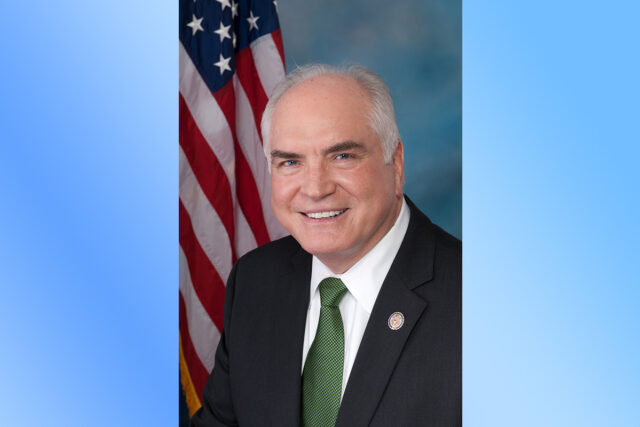

“Laws such as the Inflation Reduction Act have given the IRS unchecked and unlimited powers. That puts hardworking Americans at greater risks of an audit or other big-government overreach,” Rep. Mike Kelly said. “We’ve also seen private taxpayer information leaked and breached while in the hands of the IRS in recent years. This legislation will protect taxpayers’ banking privacy and reins in the IRS’s wide-ranging new powers.”

“For the past two years, the Biden Administration and Congressional Democrats have worked to inflate the unchecked power of the IRS by implementing a broad financial surveillance regime – putting the financial information of millions of Americans at risk,” said Congressman Drew Ferguson. “This surveillance is an invasion of privacy and it’s in every Americans best interest that we protect their private financial information. By hiring 87,000 new agents to harass and audit thousands of hardworking families, farmers, and small businesses without probable cause, the Democrat’s intent to weaponize the IRS is crystal clear and this important legislation stops this radical, big-government overreach.”

“Bank surveillance efforts are one component of a comprehensive and troubling effort led by the Biden administration to surveil and tax American families at every turn, even as they struggle under soaring inflation,” said Congressman Adrian Smith. “I thank Congressman Ferguson for his leadership on the Prohibiting IRS Financial Surveillance Act, and I will continue working with him to defend American families and small businesses.”

“The Biden administration undertook an egregious overstep of individual privacy rights by surveilling Americans’ bank accounts and jeopardizing their financial security,” said Congressman David Schweikert. “This type of behavior by the IRS is unacceptable, and I’m proud to support this critical legislation protecting the private financial information of hardworking Americans.”

“After years of scandals, including recently lost or destroyed taxpayer returns and personal data leaks, the IRS has more than demonstrated they should not be given further power over our bank accounts,” said Congressman Brad Wenstrup. “That’s why I’ve joined my colleagues in reintroducing the Prohibiting IRS Financial Surveillance Act.”

“Democrats have weaponized the IRS to go after hardworking taxpayers and small businesses with opposing views,” said Congressman Ron Estes. “Now the Biden administration has created an army of 87,000 new IRS agents that can snoop through your personal finances. Prohibiting the expansion of the unchecked powers of the IRS will protect Main Street workers and working families.”

“At the heart of Democrats’ desire to track your bank account is their fundamental belief that hard-working middle-class Americans cheat on their taxes,” said Congressman Lloyd Smucker. “No one is safe from the snooping – according to an analysis from the Joint Committee on Taxation, even Americans living below the poverty line will be watched by President Biden’s new 87,000 IRS agents. I’m proud to stand with Rep. Ferguson and my Republican colleagues on the Ways & Means Committee to prevent yet another Biden proposal of massive government intrusion.”

“The IRS is a tool used by the Biden Administration to spy on and enforce more taxes on hard-working Americans,” said Congresswoman Carol Miller. “From lowering the e-commerce threshold, to disregarding the privacy of American citizens, the Biden Administration must be held accountable. The Prohibiting IRS Financial Surveillance Act will limit government overreach and protect the financial information of Americans from being used against them.”

“Right now, every American’s financial freedom is at risk. President Biden and House Democrats wish to add 87,000 new IRS agents, snooping on your most minor transactions,” said Congressman Greg Murphy. “While the Left is hell-bent on weaponizing federal agencies against hardworking Americans, Republicans are committed to building a future that’s built on freedom. The Prohibiting IRS Financial Surveillance Act is critical in ensuring the Democrats’ oppressive agenda is stopped in its tracks.”

“The Biden Administration has worked over the past two years to weaponize an already overwhelmed IRS by implementing more burdensome reporting requirements and allocating funding for 87,000 new agents,” said Congressman David Kustoff. “The last thing American taxpayers need right now is a supercharged IRS spying on their bank accounts. I am proud to join my colleagues in introducing this crucial legislation to protect taxpayers across our country.”

“Surveillance by the IRS is an overreach that threatens Americans’ privacy,” said Congressman Brian Fitzpatrick. “Hardworking families and small businesses do not need to be burdened by IRS targeting, and this bill puts a stop to that practice.”

“The Biden Administration continues to exasperate its powers and threaten the security and privacy of millions of Americans’ financial information,” said Congresswoman Claudia Tenney. “Americans are against the President’s hiring of 87,000 new IRS Agents, and they are against any additional overreach by the IRS. I was honored to join this essential piece of legislation that works to reign in the Biden administration’s unchecked power.”

“Over the past two years, inflation has cost families an extra $10,000 and, for the past 22 straight months, inflation has outpaced wages,” said Congresswoman Michelle Steel. “The last thing Americans need is to be targeted by the government that exists to serve them. I am proud to join this bill with Rep. Ferguson to ensure transparency and accountability back to the IRS.”

“The Biden Administration’s vastly expanded IRS is designed to enforce control over American families and small businesses who are just trying to get by during this time of massive and persistent inflation,” said Congresswoman Beth Van Duyne. “Not only is the IRS’s impending intimidation campaign expected to violate privacy, it will also impose enormous costs that our small businesses cannot afford. I am proud to cosponsor this important legislation that will protect hardworking families and small businesses from this blatant attempt to infringe on the privacy of their financial information.”

“Iowans’ private financial data should never be jeopardized or collected by the IRS,” said Congressman Randy Feenstra. “The Biden Administration’s plan to track every transaction over $600 between any bank account or payment app is wrong and must be stopped. I’m proud to work with my colleagues on the Ways and Means Committee to end this federal surveillance and protect American taxpayers.”

“We and the American people believe President Biden and Congressional Democrats’ plan to hire 87,000 IRS agents is an attempt to squeeze every last penny out of hard-working Americans when the majority are already living paycheck to paycheck,” said Congresswoman Nicole Malliotakis. “Our legislation will protect American small businesses and families from being further nickel-and-dimed, audited, and harassed by the Biden Administration’s surveillance regime.”

“It is absurd to think that Americans’ bank accounts ought to be surveilled by the IRS,” said Congressman Mike Carey. “To prevent this extreme overreach, I’m proud to cosponsor the Prohibiting IRS Financial Surveillance Act to protect personal financial information and limit the powers of the IRS.”

Original Cosponsors: Representatives Vern Buchanan (R-Fla.), Adrian Smith (R-Neb.), Mike Kelly (R-Pa.), David Schweikert (R-Ariz.), Darin LaHood (R-Ill.), Brad Wenstrup (R-Ohio), Jodey Arrington (R-Texas), Ron Estes (R-Kan.), Lloyd Smucker (R-Pa.), Carol Miller (R-W.Va.), Greg Murphy (R-N.C.), David Kustoff (R-Tenn.), Brian Fitzpatrick (R-Pa.), Claudia Tenney (R-N.Y.), Blake Moore (R-Utah), Michelle Steel (R-Calif.), Beth Van Duyne (R-Texas), Randy Feenstra (R-Iowa), Nicole Malliotakis (R-N.Y.), and Mike Carey (R-Ohio).