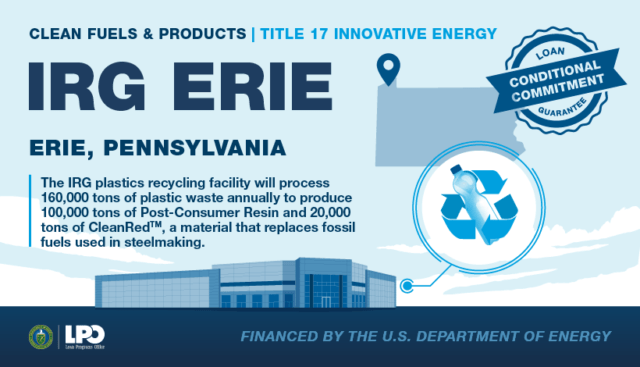

The U.S. Department of Energy’s Loan Programs Office (LPO) today announced a conditional commitment for a loan guarantee of up to $182.6 million to IRG Erie, Inc. (IRG Erie) to finance the construction of a plastics recycling facility in Erie, Pennsylvania, and an injection system tower at a steel manufacturing facility in northwest Indiana. The new recycling facility will mechanically recycle polyethylene terephthalate (PET), high-density polyethylene (HDPE), and polypropylene (PP) polymers, converting approximately 160,000 tons per year of post-consumer waste plastic into approximately 100,000 tons per year of recycled plastic materials that will be used to replace virgin plastics. The facility will also produce about 20,000 tons per year of CleanRed™ from residual plastic output.

Today’s announcement reinforces President Biden’s Investing in America agenda to create good-paying, high-quality job opportunities in communities across the country and ensure workers benefit from America’s growing clean energy economy. The project will create 334 construction jobs, including 304 jobs at the Erie plant site and 30 jobs to build the injection system at the steelmaker’s site in Indiana. The project will also create 221 operations jobs in Erie and northwest Indiana.

CleanRed™ can reduce greenhouse gas (GHG) emissions in the steelmaking process by replacing a portion of coking coal used in blast furnaces or anthracite coal used in electric arc furnaces. The CleanRed™ produced by the facility will be used by an integrated (i.e., with a blast furnace) steel manufacturer in its site in northwest Indiana. IRG Erie will be the first company in the United States to produce and sell a plastic-waste-based iron reducing agent to a domestic steel manufacturer, helping to solidify America’s position as the global leader in low-carbon iron and steel products.

The U.S. steel production industry accounts for 7% of national GHG emissions. Reducing coking coal usage in the steelmaking process will significantly lower emissions. Assuming a 14% replacement rate of coking coal used in blast furnaces, using CleanRed™ will result in a 24% reduction in GHG emissions from this process—helping move the steel sector toward net-zero emissions.

Recycled plastic production uses 50% less energy than traditional plastic production from fossil fuels, and the increased recovery rate of the plastics at this facility will result in further avoided virgin plastics production. Plastic production currently accounts for roughly 2% of total U.S. energy consumption. In total, IRG Erie is expected to avoid up to 555,000 metric tons of CO2e annually as a result of avoided virgin plastics production and emissions reductions in the steel production process. This emissions reduction is equivalent to about 190,000 tons of waste being recycled instead of landfilled each year.

The LPO financing would be offered through LPO’s Title 17 Clean Energy Financing Program, which includes financing opportunities for innovative energy and supply chain and certain state-supported projects and projects that reinvest in existing energy infrastructure.

The project also supports President Biden’s Justice40 Initiative, which established the goal that 40% of the overall benefits of certain federal investments, including LPO financing, flow to communities that are marginalized by underinvestment and overburdened by pollution. The Erie plant is located in a disadvantaged community, and 24.7% of Erie residents live below the poverty line, according to census data. The steel manufacturer is also located in a disadvantaged community. IRG Erie has strong relationships with the community and the Erie chapter of the NAACP.

As part of President Biden’s efforts to build an equitable and inclusive clean energy future, LPO borrowers are also expected to develop and ultimately implement a comprehensive Community Benefits Plan that ensures meaningful community and labor engagement and incorporates strong labor standards during construction, operations, and throughout the life of the loan guarantee.

While this conditional commitment indicates DOE’s intent to finance the project, DOE and the company must satisfy certain technical, legal, environmental, and financial conditions before the Department enters into definitive financing documents and funds the loan.